Accounting

Travel

Overview of Concur

CSUMB is joining 12 other CSU campuses in implementing the Concur Travel Management System as a complete end-to-end web-based travel solution. With the transition to the electronic process we are moving away from manual and cumbersome paper-based processes.

The integration of the travel request, travel reservations (air, hotel & car rental) and expense reporting will eliminate the travel paper processing and automate the approval workflow process all in one system. CSU policies are integrated within the three modules to make for easier reporting, approving, and processing. Employees should experience a more streamlined process, reducing the time to submit expense reports, more visibility into the approval workflow, and a faster reimbursement cycle.

Going forward the campus will not be issuing travel advances. Employees can book air travel and car rentals directly through Concur, which reduces out of pocket costs. Additionally, employees who travel at least once per year may apply for a travel card if needed.

Concur has 3 Modules:

Request (Travel Request) – Formerly known as a Request for Authorization to Travel (RAT). A travel request is required to be approved prior to making any travel reservations. Failure to obtain pre-approval puts the traveler at risk of not being reimbursed.

Travel (Concur Travel) – Concur Travel should be used to book airfare and make rental car and hotel reservations through the CSU approved contracted travel agency, Christopherson Business Travel (CBT). Bookings for air travel and car rentals made through Concur Travel are paid directly by the university, resulting in no out of pocket cost to the traveler (excluding incidental charges that may be incurred, e.g., checked luggage fees).

Expense (Expense Report) - Formerly known as Travel Expense Claim (TEC). An expense report is required to be submitted within 60 days for all business travel per CSU policy. Expense reports submitted more than 60 days after the end date of the trip is considered taxable income per IRS regulations. Completing an expense report ensures that all expenses are reconciled, and is the mechanism for requesting reimbursement in cases where out of pocket costs were incurred.

System Integrations

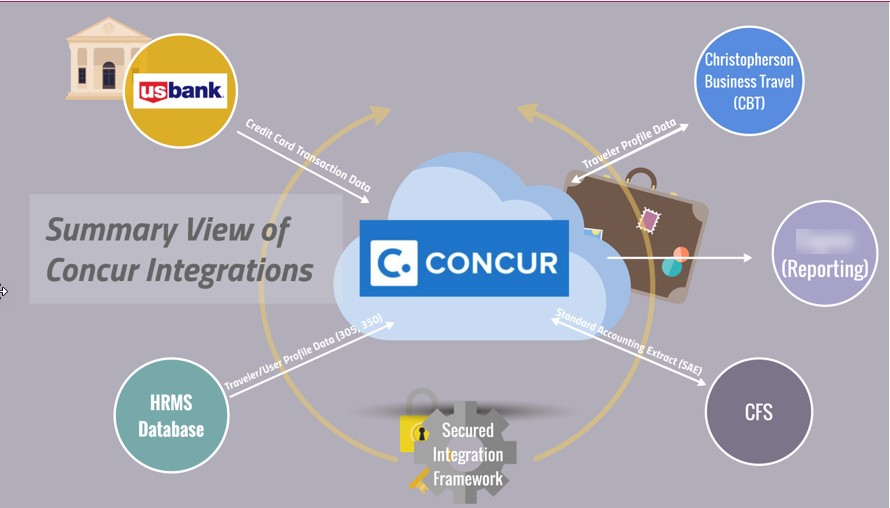

Below is an illustration of the Concur Travel System’s Integrations with US Bank (Travel Card), Christopherson Business Travel (Travel Agent), HRMS Database, CFS and Reporting.

Approval Workflow:

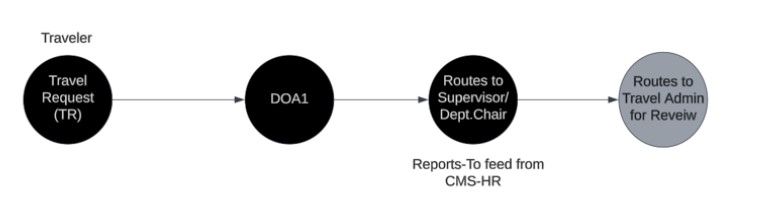

Below is the automated approval workflow in Concur. Travelers can check the status of their Request at any time by clicking on the Request Details tab and selecting 'Audit Trail' or 'Timeline'. If your department requires more signatures than is set as the default within Concur, you or anyone in the approval workflow may add as many Additional Signers as needed.

Roles & Responsibilities of Approvers

Delegation of Authority (DOA1) Approver:

- Validate chartstring (fund, dept, etc.)

- Review expenses to confirm they align with approved budgets

- Review for travel policy compliance

- Confirm that all necessary documentation, such as agendas or other required attachments, is included and complete

- Add an additional approver if required to comply with department-specific policies and approval workflows

Supervisor/Dept. Chair Approver:

- Review destination and related alerts (e.g., high hazard destinations, international, etc.)

- Confirm/Approve business purpose of trip

- Review all expenses and attachments for reasonableness and completeness

- Confirm that the employee is not on vacation or leave during the requested business travel dates

- Approve use of budget, if applicable

- Add an additional approver if required to comply with department-specific policies and approval workflows